NI 43-101 Work Confirms High-Grade Epithermal Silver System, Favorable Metallurgy, Existing Infrastructure, and Strong Community Engagement in Huachocolpa District

Vancouver, British Columbia – January 5, 2026 – Rio Silver Inc. (TSX-V: RYO | OTC: RYOOF) (“Rio Silver” or the “Company”) is pleased to provide an update on its Maria Norte gold-silver-lead-zinc Project in central Peru, following the completion of recent technical work and site activities conducted in accordance with National Instrument 43-101. The results confirm the presence of high-grade silver mineralization, favorable geological and metallurgical characteristics, and a clear pathway toward near-term development within one of Peru’s most prolific silver districts.

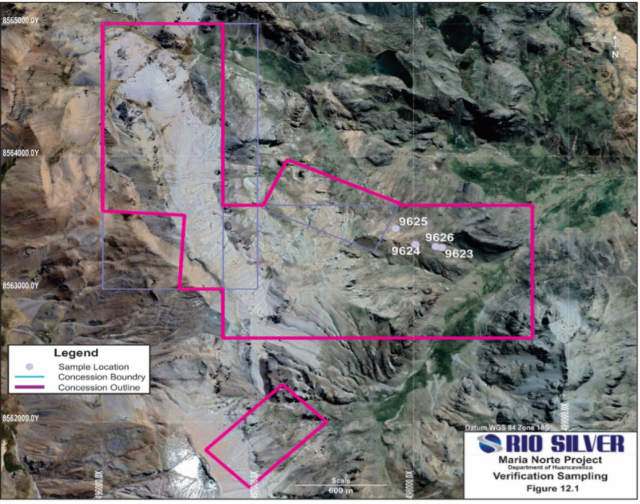

Figure 1: Maria Norte Silver Project – NI 43-101 Verification Sampling Locations

Map outlining concession boundaries and surface verification sampling locations at Rio Silver’s Maria Norte high-grade silver project in central Peru.

High-Grade Silver Confirmed by Verification Sampling

As part of the independent National Instrument 43-101 review, verification sampling was conducted by James A. McCrea, P.Geo., the independent author of the NI 43-101 Technical Report, during a site visit to the Maria Norte Project in June 2025. Sampling targeted surface vein exposures and historic waste material and returned high-grade silver values, including:

- 869 g/t silver, with associated lead and zinc, from a 5-metre surface vein channel sample

- 991 g/t silver from a 7-metre surface vein channel sample

- 396 g/t silver from a historic waste dump grab sample

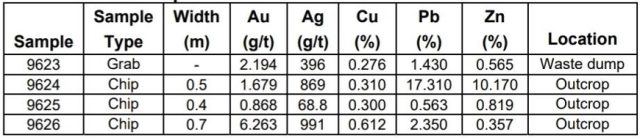

Table 1: Maria Norte Verification Sampling Results (NI 43-101)*

*Verification sampling returned silver values ranging from 396 g/t Ag to 991 g/t Ag, with associated lead, zinc, and localized gold values. These results confirm the presence of high-grade silver mineralization at surface, consistent with historical sampling by previous operators and characteristic of low-sulphidation epithermal vein systems common to the Huachocolpa District.

A total of four (4) verification samples were collected, consisting of three (3) chip samples from surface vein outcrops and one (1) grab sample from a historic waste dump, with chip sample widths ranging from approximately 0.4 metres to 0.7 metres. All samples were bagged, labelled, and sealed in the field using single-use security ties, transported by the author to Lima, Peru, and analyzed by Certamin S.A., an ISO 9001–certified laboratory located in the Santiago de Surco municipality of Lima.

No additional quality control samples (blanks, standards, or duplicates) were inserted due to the limited number of samples collected, which the author considered appropriate for the exploration stage of the project. James A. McCrea, P.Geo. concluded that the sampling methods, sample handling, preparation, and analytical procedures are adequate for data verification purposes, and that the results are representative of the surface mineralization observed at Maria Norte.

CEO Comment

“The confirmation of high-grade silver at Maria Norte reinforces what initially attracted us to this project,” said Chris Verrico, President and Chief Executive Officer of Rio Silver. “These are good grades in a district known for long-life silver production, and as our team continues work on the ground, we are seeing encouraging geological indications that suggest the system may extend beyond what is currently exposed. Combined with existing infrastructure, favorable metallurgy, and strong community engagement, we believe Maria Norte offers a compelling opportunity to advance toward development while continuing to unlock further upside.”

Proven Geological Setting in a Renowned Silver District

Maria Norte is situated within the Miocene polymetallic belt of central Peru, a region that has supported decades of silver production from structurally controlled epithermal vein systems. Mineralization at Maria Norte occurs within quartz-sulphide veins and breccias, hosting silver-dominant mineralization with associated lead, zinc, and local gold values.

Mapping and structural interpretation indicate that mineralization is controlled by a well-defined vein corridor with favorable geometry for continuity along strike and at depth. This geological setting mirrors other productive operations in the district and supports the Company’s development-focused exploration strategy.

Infrastructure, Metallurgy, and Development Readiness

Historic metallurgical test work reviewed by the Company indicates that mineralization at Maria Norte responds to conventional flotation methods. Combined with the project’s location within a well-established mining district, this supports a development approach that emphasizes efficiency and capital discipline.

Key advantages at Maria Norte include:

- Favorable Metallurgy: Historic test work indicates amenability to conventional flotation processes.

- Established Infrastructure: Road access and operating processing facilities are located approximately 11 kilometers from the project.

- Reduced Capital Intensity: Proximity to existing mills has the potential to lower upfront capital requirements, shorten development timelines and reduce exposure to environmental costs related to mill operation.

- Experienced Mining District: Maria Norte is located within one of Peru’s longest-producing silver regions, which has a well-established, supportive mining culture, and experienced local workforce.

Following the recent approval of the Maria Norte acquisition, Rio Silver has advanced boots-on-the-ground activities, including site access planning, infrastructure assessments, and early permitting preparations. In parallel, the Company continues constructive engagement with local community leaders, building on a foundation of cooperation in one of Peru’s most established and supportive mining regions.

Positioned for Near-Term Development

Rio Silver’s strategy at Maria Norte is focused on advancing accessible, high-grade mineralization through staged development while continuing exploration to expand the known system. Under Peru’s established exploration and exploitation framework, development activities can progress alongside exploration, allowing the Company to advance the project efficiently and responsibly.

Management believes that the combination of verified high-grade silver, nearby processing capacity, and an experienced in-country team places near-term development firmly within the Company’s strategic horizon, subject to continued technical success and permitting.

Next Steps

- Advance Development Planning at Maria Norte: Continue site preparation activities, infrastructure assessments, and permitting work in support of staged underground access targeting accessible high-grade silver mineralization.

- Expand Geological Understanding of the System: Complete detailed mapping, channel sampling, and geophysical surveys to refine priority targets and assess continuity along strike and at depth within the known vein corridor.

- Progress Community and Stakeholder Engagement: Maintain active dialogue with local communities and stakeholders to finalize access agreements and support responsible development as work programs advance.

- Parallel Metallurgical Work at Santa Rita: Advance ongoing metallurgical test work to better understand mineral processing characteristics while technical evaluations and project integration continue.

Why This Matters to Investors

As global silver markets continue to experience structural supply deficits, projects capable of advancing high-grade silver toward development are scarce. Maria Norte stands out due to its verified grades, district-scale setting, proximity to operating mills, and disciplined development strategy. With key technical milestones achieved and field activities advancing, Rio Silver believes it is well positioned to deliver continued progress and value creation for all stakeholders as the silver cycle unfolds.

Data Verification and Qualified Persons

The author’s verification samples were sent to Certamin S.A. laboratories in the Santiago de Surco Municipality of Lima. Samples were collected in the field under the supervision of the author, as chip samples from vein outcrops and a grab sample from a waste dump; the samples were bagged, labelled and sealed with one-use ties at the time they were taken. The samples were transported by the author, from the Project to Lima and then to Certamin S.A. in Lima for final preparation. Certimin complies with ISO 9001, OHSAS 18001 and is a fully recognized and certified facility. Locations of the samples were outlined NI43-101 Technical Report on the Maria Norte Au-Ag-Pb-Zn by Independent Geologist James McCrea P.Geo filed on Sedarplus December 16th, 2025.

Historic metallurgical work and the results are also summarized in Mr. McCrea’s NI43-101 report as follows: “three metallurgical samples from the Maria Norte veins that had been previously worked by Buenaventura were sent to Procesmin Ingenieros S.R.L. in Caraz, Ancash. The primary objective of the test work was to collect 2 samples to perform metallurgical testing of the mineralization present in the veins that were worked by Buenaventura and a sample also for preliminary metallurgical testing of a vein located in the Plata 33 concession, where another vein with previous exploitation works was sampled. All samples were sent to a laboratory in Caraz was to determine the samples response to concentration by froth flotation.”

Jeffrey Reeder, P.Geo., is a Qualified Person as defined by National Instrument 43-101 and has reviewed and approved the technical information contained in this news release. Mr. Reeder is a consultant to the Company and is not independent within the meaning of NI 43-101.

About Rio Silver Inc.

Rio Silver Inc. (TSX-V: RYO | OTC: RYOOF) is a Canadian resource company advancing high-grade, silver-dominant assets in Peru, the world’s second-largest silver producer. The Company is focused on near-term development opportunities within proven mineral belts and is supported by a seasoned technical and operational team with deep experience in Peruvian geology, underground mining, and district-scale exploration. With a clear development strategy, and a growing portfolio of highly prospective silver assets, Rio Silver is establishing the foundation to become one of Peru’s next emerging silver producers.

Learn more at www.riosilverinc.com

ON BEHALF OF THE BOARD OF DIRECTORS OF RIO SILVER INC.

Chris Verrico

Director, President and Chief Executive Officer

To learn more or engage directly with the Company, please contact:

Christopher Verrico, President and CEO

Tel: (604) 762-4448

Email: chris.verrico@riosilverinc.com

Website: www.riosilverinc.com

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking statements” within the meaning of applicable Canadian securities laws. All statements in this release that are not historical facts are forward-looking statements and are based on expectations and assumptions as of the date of this release. Forward-looking statements relate to future events or performance and include, but are not limited to, statements regarding the Company’s planned exploration and development activities at the Maria Norte Project, expected timelines for regulatory approvals, future work programs, engagement with local stakeholders, geological interpretations, and the Company’s ability to advance its assets toward potential development.

Forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied. These risks include, but are not limited to, operational risks, regulatory risks, geological uncertainties, availability of financing, community and social risks, commodity-price fluctuations, and general economic conditions. Additional risks are described in the Company’s filings available on SEDAR+ at www.sedarplus.ca .

Readers are cautioned not to place undue reliance on forward-looking statements. Rio Silver does not undertake to update forward-looking statements except as required by applicable law.

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.