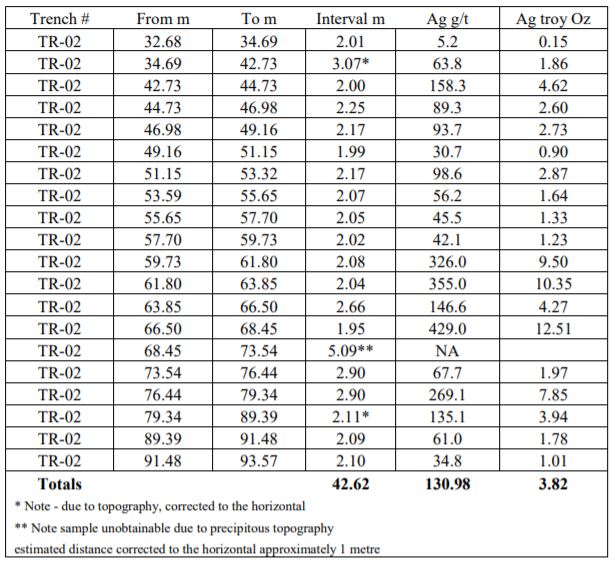

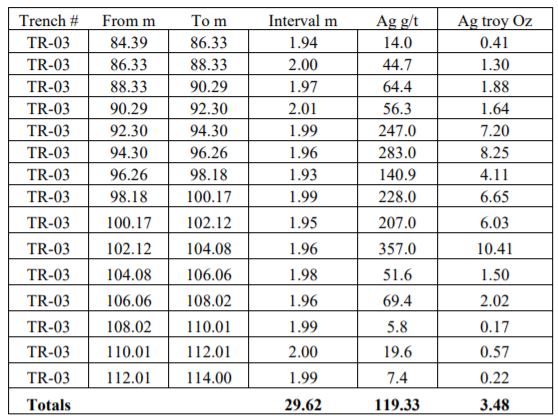

January 14, 2013, Toronto, Ontario, Canada – Rio Silver Inc. (the “Company”) (TSX.V: RYO) is pleased to announce that the Company has completed its 2012 surface and trench sampling program on its 100% owned (no underlying royalties), 2100 hectare Niñobamba project, located approximately 330 kilometres southeast of Lima, in the Department of Ayacucho, Peru. The Company views the project as a bulk mineable disseminated silver target. In total seventeen trenches were excavated by the local community and the results of the first five trenches have been previously published with highlights of 56 metres of 1.03 g/t Au and 98.9 g/t Ag in trench TR-01, 42.62 metres of 130.98 g/t Ag in trench TR-02 and 108.49 metres of 62.4 g/t Ag in trench TR-05 (see Company’s news releases dated July 4, 2012, September 4, 2012 and October 22, 2012). Highlights from new trench results show trench TR-13 returning 165.06 g/t Ag over 20.01 metres, trench TR-16 returning 99.35 g/t Ag over 21.05 metres and trench TR-17 returning 41.85 metres of 37.59 g/t Ag.

The 2012 exploration program focused on two parallel mineralized zones, the “North” and “South” zones which appear to be two separate NE-SW trending zones of significant silver mineralization. The zones are approximately 400 metres apart and have variable thickness. A new zone called “Dilation” was discovered between the North and South zones with 16 surface grab samples averaging 19.98 g/t Ag and ranging from 0.0 to 142.9 g/t Ag. A second new zone called “Escondida” was also discovered approximately 500 metres southwest of trench TR-02 with 12 surface grab samples averaging 72.03 g/t Ag and ranging from 0.8 to 252.6 g/t Ag. Gold is present in the Escondida zone with 12 samples ranging from 0.0 to 0.799 g/t Au and averaging 0.140 g/t Au.

The following is an orthophotograph of the Niñobamba Property showing the North and South mineralized zones as trenched, and the new zones of mineralization at Dilation and Escondida. The orthophotograph also shows the favourable topography for mining and infrastructure.

North Zone Trenching Results

The 2012 exploration program shows that the mineralization in the North zone has a lateral extent of over 400 metres. Recent surface sampling west and north of trench TR-04 shows that gold mineralization is associated with vuggy silica altered volcanics similar to the mineralization exposed in the last 21.77 metres of trench TR-04 which returned 1.32 g/t Au and 102.46 g/t Ag. The alteration in this area has a strong gold zoning component indicative of high sulphidation systems. The silver mineralization exposed in trenches TR-13, TR-16, and TR-17 are located between the gold bearing trenches in TR-01 and TR-04. The silver mineralization in these trenches is approximately 70 meters lower in elevation compared to trenches TR-01 and TR-04 which further supports that the North zone contains a gold-silver zone and a pure silver zone. Trench TR-13 was terminated at its south end due to deep colluvium cover where the last sample returned 185.2 g/t Ag.

South Zone Trench Results

Trenching has exposed the silver mineralization for over 400 metres in the South zone. Highlights from the recent trenching results show that the most easterly trench TR-07 returned 23.80 metres of 83.06 g/t Ag. Additionally, historical drill results approximately 200 metres east of trench TR-07 suggest that the silver mineralization continues to the east. The most westerly trench in the South zone, trench TR-02 returned 42.62 metres of 130.98 g/t Ag. The new Escondida zone is located a further 500 metres to the southwest of trench TR-02 and it is likely this new zone is the lateral extension of the South zone. This may expand the potential for the South zone to over 1100 metres. The precious metal mineralization thus

far determined in the South zone is predominantly silver compared to the North zone which has considerable gold credits.

The attached map shows the location of the trenches, historic drill holes and the new zones identified from surface grab sampling. The following table summarizes all of the 2012 trenching results. The trenching program and other surface exploration work will continue in 2013 once weather conditions

improve. The Company will also initiate the permitting process to commence a first phase drill program.

Geochemical samples were collected by Mine Gate Exploration SA personnel using rock saws cutting continuous channels in bedrock averaging 2.5 inches wide and 3.5 inches deep. Samples were collected irrelevant of geological boundaries and later surveyed. The quality of the sampling is considered high and representative of the grade of the mineralized system at surface.

I’m sure I’m not the only customer of https://healthyduluth.org/buy-soma-online/ who got a personal discount, but for me, it was priceless. On seeing the cost of the medication I needed, I decided to refuse treatment and ask my doctor for soma cheaper medication. However, a 40% discount made me change my decision, and I ordered the drug right away. I’m so grateful for such a present from https://abrahamdentalart.com/ambien-online/.

Standards and blanks were inserted for internal quality assurance/quality control. Under chain of custody the samples were delivered to Inspectorate Services Peru SAC, in Callao, Peru which is an ISO 9001:2000 certified laboratory at the global level with ABS QUALITY EVALUATIONS. The samples were prepared for analysis by standard procedures and were analyzed for 32 elements determined by multi-element ICP (inductively coupled plasma) with aqua regia digestion. Silver was assayed for by acid digestion with an atomic absorption finish (Ag-4-OR) and gold was analyzed separately by fire assay with an atomic absorption finish (1AT FA-AA).

Jeffrey Reeder, P.Geo., Director of the Company is the Qualified Person who has reviewed and is responsible for the technical data contained in this news release.

ON BEHALF OF THE BOARD OF DIRECTORS OF RIO SILVER INC.

T. John Magee

CEO and President

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

This news release includes forward-looking statements that are subject to risks and uncertainties. All statements within, other than statements of historical fact, are to be considered forward looking. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration successes, continued availability of capital and financing, and general economic, market or business conditions. There can be no assurances that such statements will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. We do not assume any obligation to update any forward-looking statements.

For more information contact

T John Magee, P.Geo.

Tel: (416) 479-9546

Website: www.riosilverinc.com